Award-winning PDF software

Form 8862 Online West Covina California: What You Should Know

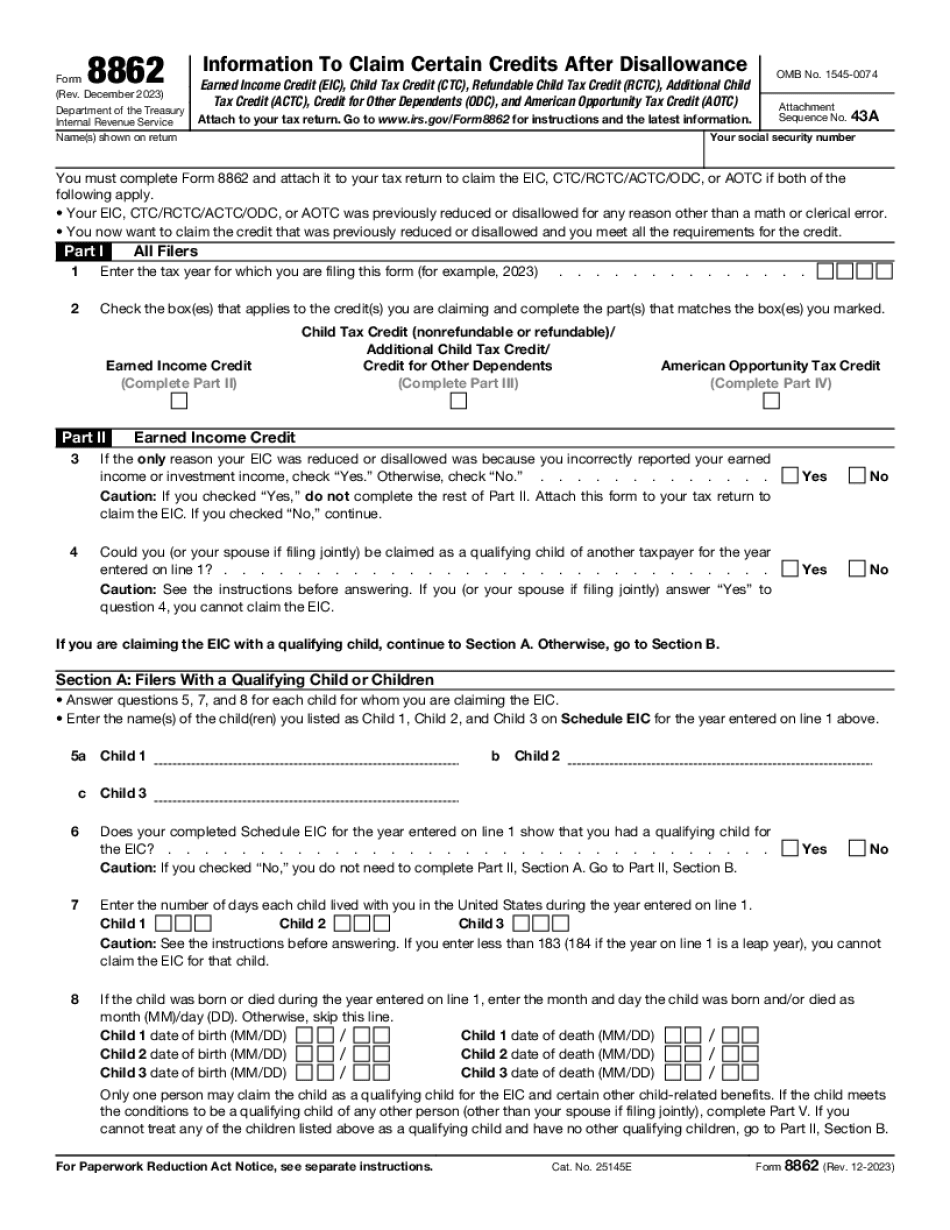

The EIC provides a 6,000 tax credit for individuals and 12,000 for couple(s) each year of eligibility. The EIC can be used to reduce the amount of tax that an individual or a married individual filing jointly would owe. Tax form 8862: Fill out & sign online — Chub Edit, sign, and share IRS Form 8862 online. No need to install software, just go to Chub, and sign up instantly and for free. Tax form 8862: Fill out & sign online — Chub. Tax form 8862: Fill out & sign online — Chub Read how to claim the EIC or the ATC (tax return) — Mar 11, 2024 — Form 1040, U.S. Government Form 2065, and the IRS forms 1040A, 1040EZ, and 1040A/1040EZ-EZ are used to claim the earned income tax credit, which is a refundable tax credit available to Americans to reduce their taxable income. The EIC (Earned Income Credit) offers an additional reduction on income taxes that may be owed by taxpayers that have qualifying family members who would otherwise qualify for the ETC. The EIC gives eligible taxpayers the same amount of tax credit, but it replaces a portion of an earned income tax credit, which can be a valuable cash reduction for families who make too much money to be eligible for both the ETC and the EIC. See tax forms 1040, 2065, and 1040A for the EIC and the ETC. What is the EIC? — TaxForms.com How to claim the EIC — TaxForms.com EIC = earned income credit = CTC = child tax credit = ATC = additional child tax credit A tax return form that tax filers must complete is the EIC. The EIC allows you to take a cash refund of up to about 6,100 of income taxes that your individual income tax bracket would otherwise have taxed. The maximum EIC amount of cash refunds is 2,700 per tax return. If you qualify for the maximum EIC for your tax bracket, but your taxable income still exceeds the EIC by more than 2,700, your refund is reduced by the amount of refunds that you would normally owe if your income had exactly the same tax bracket.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 Online West Covina California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 Online West Covina California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 Online West Covina California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 Online West Covina California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.