Award-winning PDF software

Form 8862 for Gilbert Arizona: What You Should Know

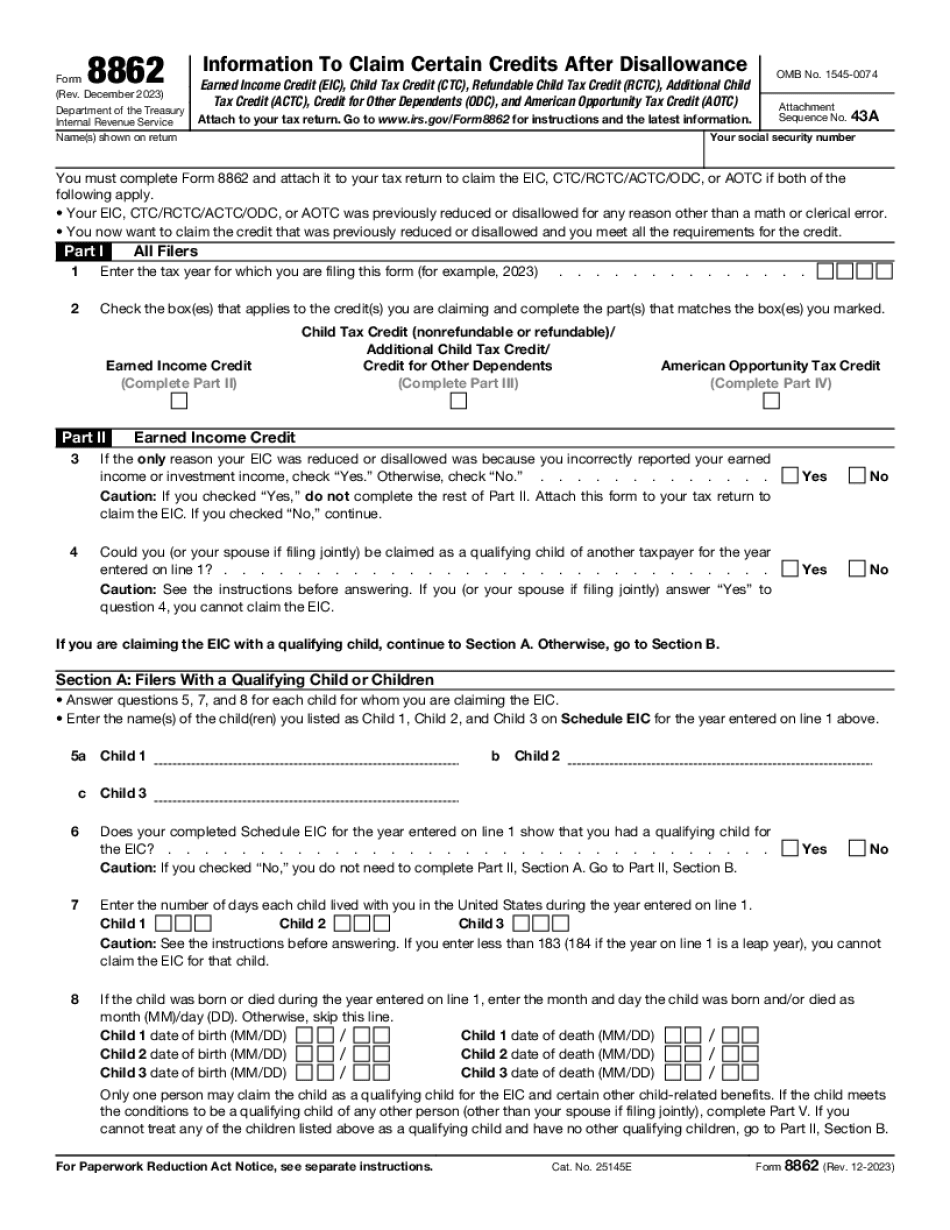

What's your EIN? In the past, I've listed the Social Security number of those you have applied for exemption/credit. These people are often called EIN holders, because they are allowed to claim as an exemption an EIN of their own. You can't use your Social Security number of someone who is not the owner of the address and should not be included in the Form 8862 instructions. It is important to note that if you get your Social Security number through an employee benefit program, it is a legal EIN which you can use for exemption purposes. However, if you don't have your own EIN, you would be required to use this number for purposes of exemption (and to be refunded tax withheld on past tax returns)! Who Needs Form 8862? Taxpayers under 18 years of age, and those who have a disabled parent. You can obtain tax-exempt status by this EIN if: Your parent's name is omitted you are the spouse of this person and are filing as the dependent on the parent's return you are the person who is the custodian for the dependent You can also obtain tax-exempt status if: Your parent has been a resident of the State, District or country for at least 13 months, and you have resided there (i.e., permanently) or have been working or attending school in the State for at least 16 months you are a surviving spouse or the person who has a dependent child with a disability. You can't get tax-exempt status if you have a disability as a disabled parent. An exception to this restriction is made in situations that would otherwise require an employee benefit plan (see next step). Do You Need to File a Filing Claim? You do need to file a statement. A “filing claim” is the final word on whether an individual or entity has filed a valid tax return and if so, the basis for their claim. If you or your parent do not have a valid tax return, no tax can be withheld, and you should file a claim immediately. You should consult with your financial office to determine whether your claim will help you, and what action, if any, your financial office will take. Filing claims that provide no relief in your case are known as “NON-APPLICATION CLAIMS”. The IRS advises not making claims on behalf of a person or entity unless your filing claim is supported by supporting documentary evidence.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 for Gilbert Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 for Gilbert Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 for Gilbert Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 for Gilbert Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.