Award-winning PDF software

Form 8862 Houston Texas: What You Should Know

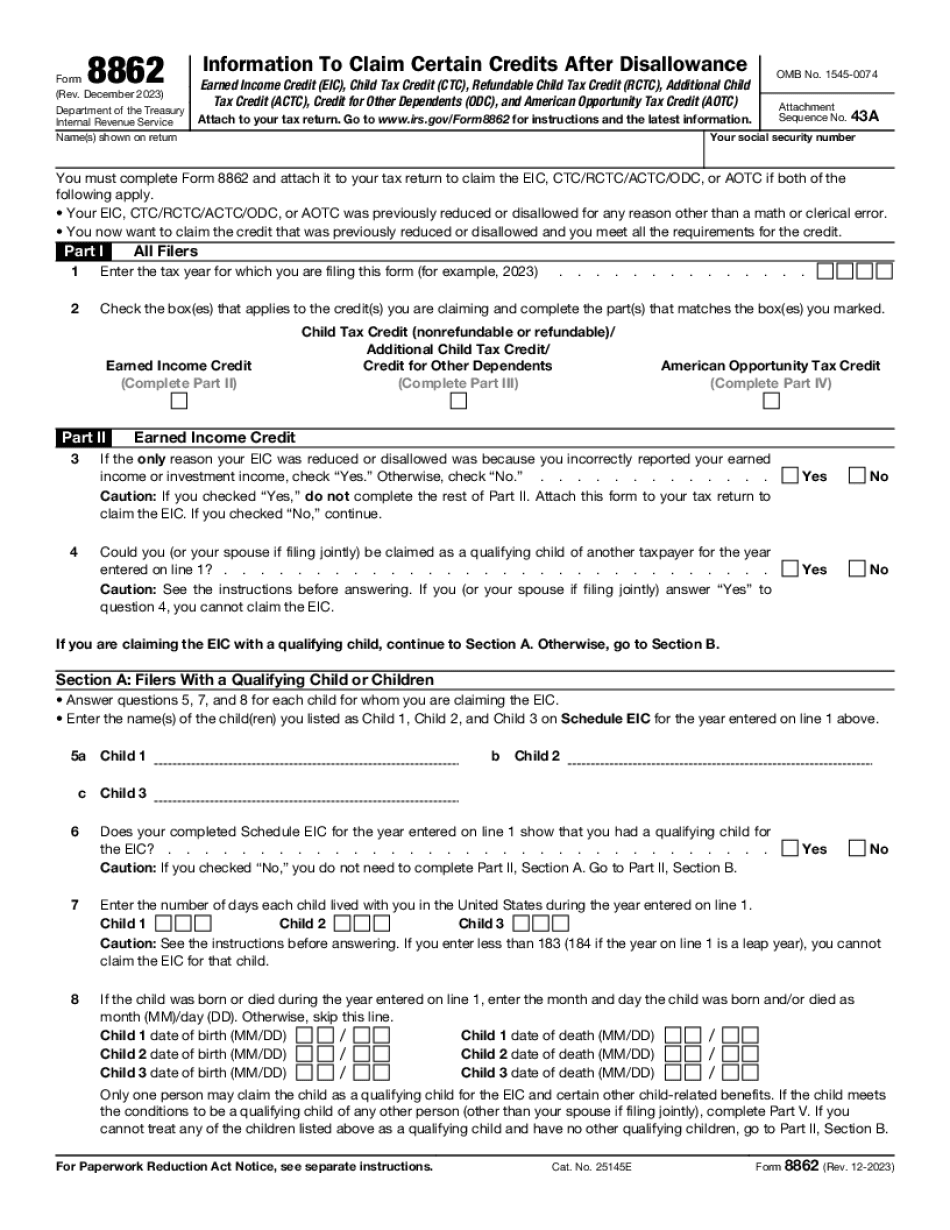

You may claim a refund of up to 1,500 on the reduced or disallowed amount. Filing Notice of Federal tax lien or levy on property May 19, 2024 — Filing a claim for a federal taxes lien on land, buildings, or fixtures owned by the City of Houston because of a debt to city, is prohibited. Such liens can be settled with the use of city money. Form 8500: Filing a tax return under penalty of perjury Nov 11, 2024 — Forms 709, 708, 787, 788 and 789 are required to be filed or a penalty of 300 per incorrect form must be payable to the IRS to be waived for the filing. Form 8862, Information To Claim Certain Credits After Disallowance, including recent updates, and supporting information, such as tax forms and instructions on how to file. Please download and use Form 8862 now. Tax Tip: Filing Tax Returns With Form 8862: The Right Tool for the Job— IRS Tips for using the form to file your federal, Texas, and Houston city tax returns. Mar 20, 2024 — As of mid-2010, all qualified taxpayers (those with adjusted gross income less than 65,000) can file with just two (2) documents (2) for the information on the new EIC, including the new ATC program; Form 8862. Federal Tax Rates for 2017 Jan 27, 2024 — The Federal Income Tax Rate for the City of Houston (and not the state of Texas) for the Fiscal Year ending March 2024 is 9.06 percent (9.06%). The Federal Income Tax Rate for the State of Texas (and not the City of Houston) for the Fiscal Year ending March 2024 is 12.00 percent (12.00%). Filing Tax Return Information To Claim Certain Creditable Items The filing rules are the same regardless of whether the filing is electronic or paper, including the information to claim these eligible credits. Mar 22, 2024 — Taxpayers can complete the Form 8862 and attach it to their tax returns to claim them on the EIC, credit reduction, or ATC program. These credits only benefit low income persons, and can be paid by the state of Texas through the Texas Exemption Fund for low and moderate income persons.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 Houston Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 Houston Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 Houston Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 Houston Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.