Award-winning PDF software

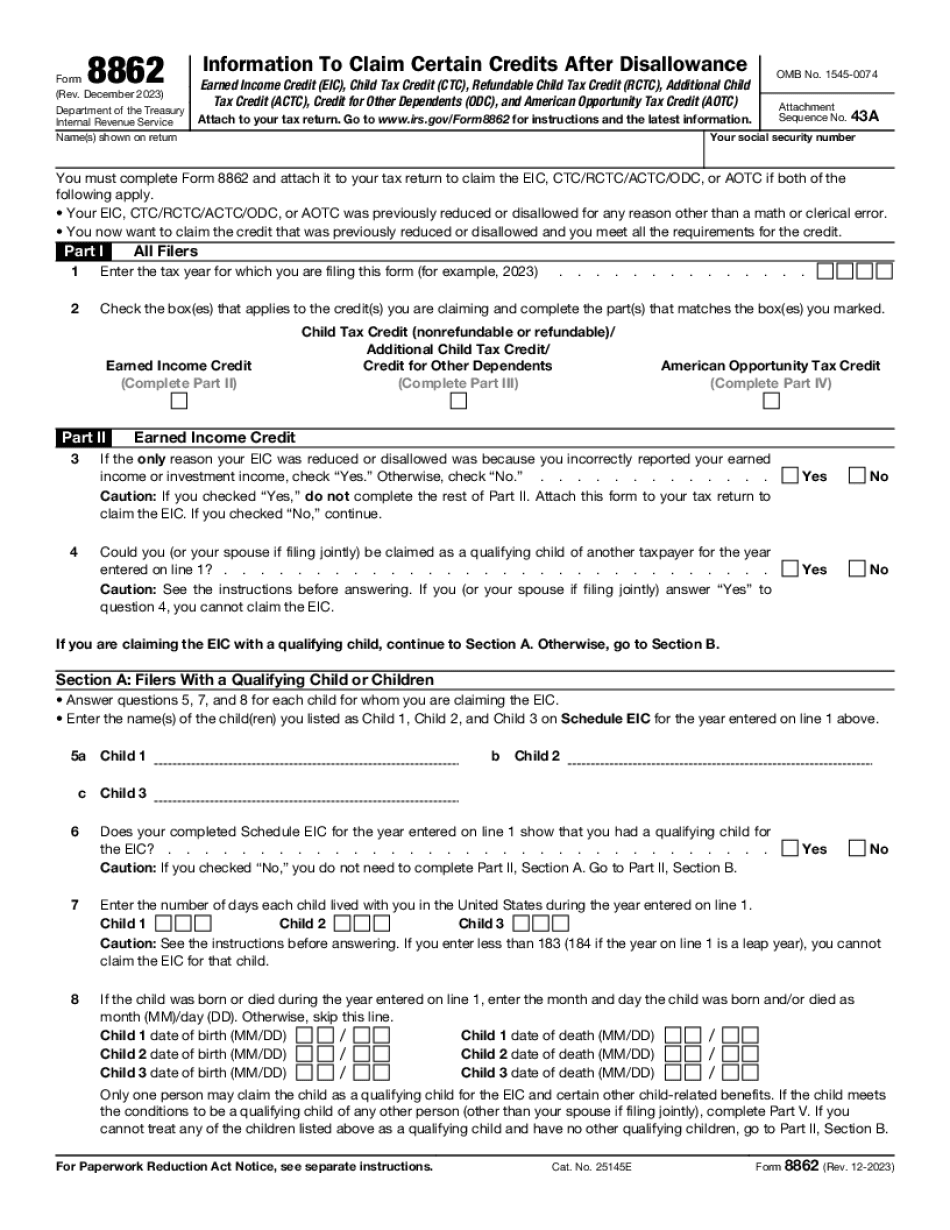

Printable Form 8862 Olathe Kansas: What You Should Know

Pinnacle's accounts are prepared with great care. Pinnacle makes every effort to complete Form 5329 on time and on schedule and to provide timely responses to every request. Pinnacle's firm is committed to providing its users with the best services and best work environment possible, and if you have any additional questions about Pinnacle Services, please do not hesitate to contact us. Frequently Asked Questions About Form 5329 Q: What am I sending to the IRS when I get the Form 5329? A: What you are sending to the IRS should be similar to what you would have sent to the IRS before. You should have a copy of Form 5329. Q: If I get the Form 5329, will I be able to file a Schedule C? A: Yes, if you have been issued a Form 5329, the IRS will issue you a Form C-2, which will allow you to file a Schedule C when the IRS notifies you that you are eligible and has sent you Form 5329. Q: Does the IRS send Form 5329 if my plan is not an IRA? A: The government does not currently have tax consequences on a plan that is not an IRA, and there is no reason to have a plan that does not qualify as an IRA (as an IRA plan is defined only by a trustee-to-trustee transfer). If the plan to which you have contributed is a tax-qualified plan, you should file a Schedule C with your tax return. Q: Am I supposed to pay a penalty on my Form 5329? A: An individual who fails to file Form 5329 on or before the due date (generally April 15) or who files Form 5329 after the due date (generally 30 days after the due date) generally will not be subject to a tax penalty or the denial of tax benefits for failure to timely file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8862 Olathe Kansas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8862 Olathe Kansas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8862 Olathe Kansas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8862 Olathe Kansas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.