Award-winning PDF software

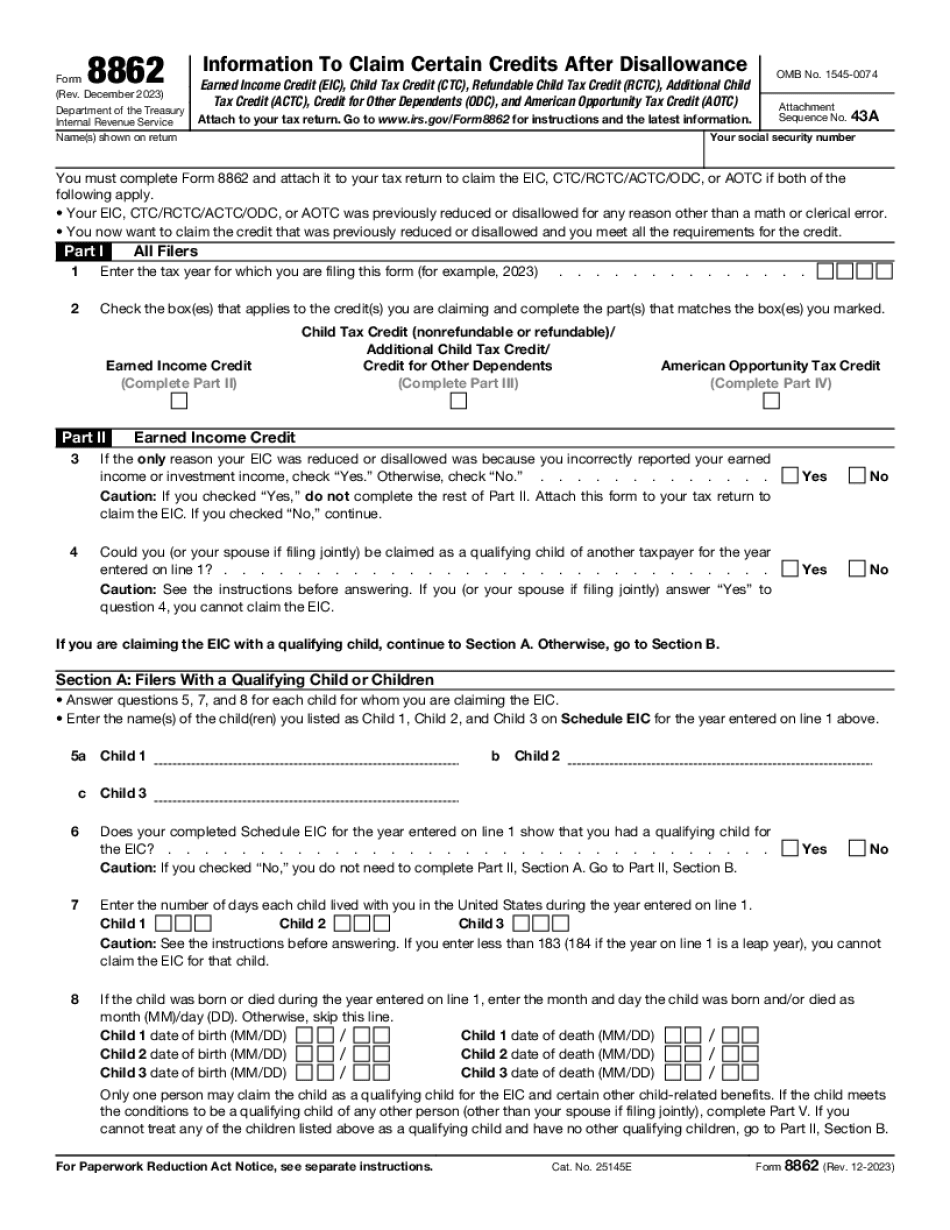

Form 8862 Texas Dallas: What You Should Know

It is a credit that is available to taxpayers when they, for whatever reason, are not required to itemize deductions on their tax returns. The amount of EIC is based on the taxpayer's adjusted gross income (AGI) on a tax return. The amount of EIC that can potentially be claimed is limited to the amount shown on the tax return. EIC is automatically subtracted from the amount of each state or local income tax (SIL) or sales tax (SST) owed. For a full discussion of the Credit and when you can take advantage of it, please check out our IRS Publication 551. The EIC may not be the right credit for you depending on your family's situation. Each taxpayer is required to fill out the EIC form. You can go to Step 2 in the instruction sheet on IRS.gov or the EIC Instruction Sheet to determine if you are eligible for EIC, or you can ask your tax advisor or accountant to advise you. You may also want to consider contacting a local tax professional to help determine if you may qualify for the EIC. To learn more about the Earned Income Tax Credit, check out the IRS.gov “about us” page, and follow the links there to read additional information. What do I need to complete Form 8862? You do not need to complete Form 8862 all at one time. Complete each individual itemized deduction on your tax return on a separate page, then complete any adjustments for credits or exemptions you have based on the deductions you have completed and signed, and finally complete the Form 806 for Form 1040, 1040A, or 1040EZ. A completed Form 8862 should look similar to the example in Table 2. Form 8862 has a very important section for you to read. In Section 13, you should be prepared to identify any information that your tax advisor or accountant cannot find to be important to you when you are planning your tax return but is still necessary. The information you must include on Form 8862 may be the key to receiving the EIC. Table 2: Example of information to include on Form 8862 Part I, Items to Include on Form 8862 You may include any information here you would like to appear on Form 8862. Item 1. General information (page 1) Item 2. Eligibility information (page 2) Item 3. Number of dependents not claimed (page 3) Item 4.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 Texas Dallas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 Texas Dallas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 Texas Dallas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 Texas Dallas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.