Award-winning PDF software

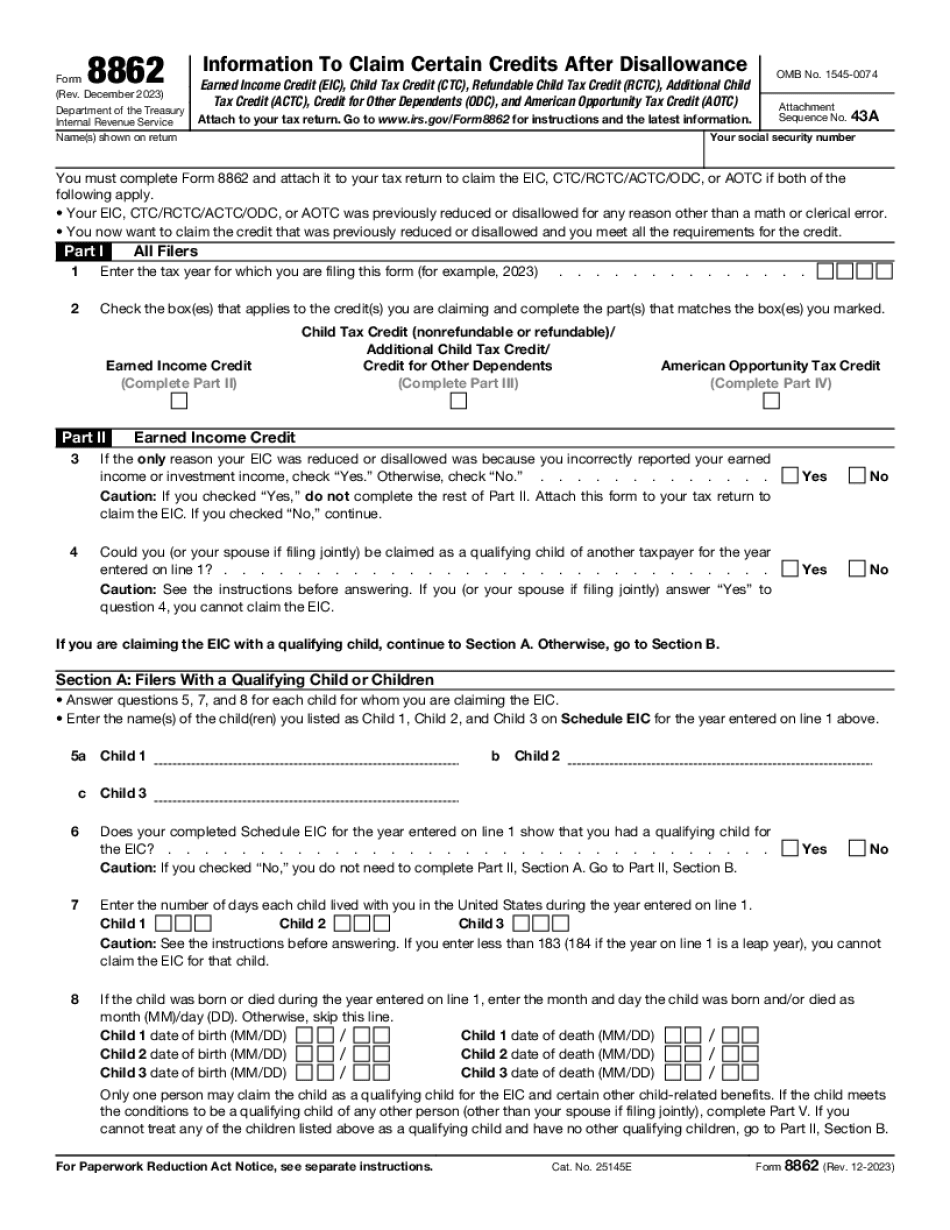

Form 8862 for Santa Clara California: What You Should Know

Form. Submit this form to the Dental Section to receive 20 annually. You must attach it to your employment contract or employee benefits package before the end of the calendar year. Use Form 2877 to apply to the dental office to receive 20 for a dental cleaning. · Employment Tax Credit. Filed on the correct form for the individual filing his or her taxes. Note: If you are filing your taxes on more than one form, use a separate sheet to each Form 2877 you need. · Employment Tax Credit Form. Attach this form to your employment contract to receive a 10 Employment Tax Credit for the first 1,000 annually as long as you meet all eligibility requirements. · Qualifying Child Tax Credit Form. Attach this form to your unemployment insurance (UI) benefits to receive a 100 Child Tax Credit for the first 1,000 yearly. · Form 1612A or 1613A for Employees of Federal Financial Resources Entities (FF RNE) If Form 1612A (or 1501B-2), and/or Form 1612A-1, are filed during the calendar year by any of the following entities, such entity may claim a tax credit against their Social Security taxes for the amount of the tax credit: Federal Financial Resources Entities, that is, Forces. These entities are private, for-profit businesses that may purchase, own or operate publicly traded investment securities and/or bank loans. Such entities include: ● The Federal Reserve System, the United States Treasury, the Federal Deposit Insurance Corporation and the Commodity Futures Trading Commission. (Note that the term “federal financial resources” (FF RNE) only includes those activities not directly funded by tax dollars.) ● The Department of Labor (DOL) as well as the Social Security Administration (SSA). ● The Office of the United States Trade Representative (USER), and the Secretary of Labor's Office of International Affairs (OLGA). (OIL does not file a form with the Department of Labor.) the Office of Personnel Management (OPM). (OPM does not file a form with the Department of Labor.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 for Santa Clara California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 for Santa Clara California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 for Santa Clara California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 for Santa Clara California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.