Award-winning PDF software

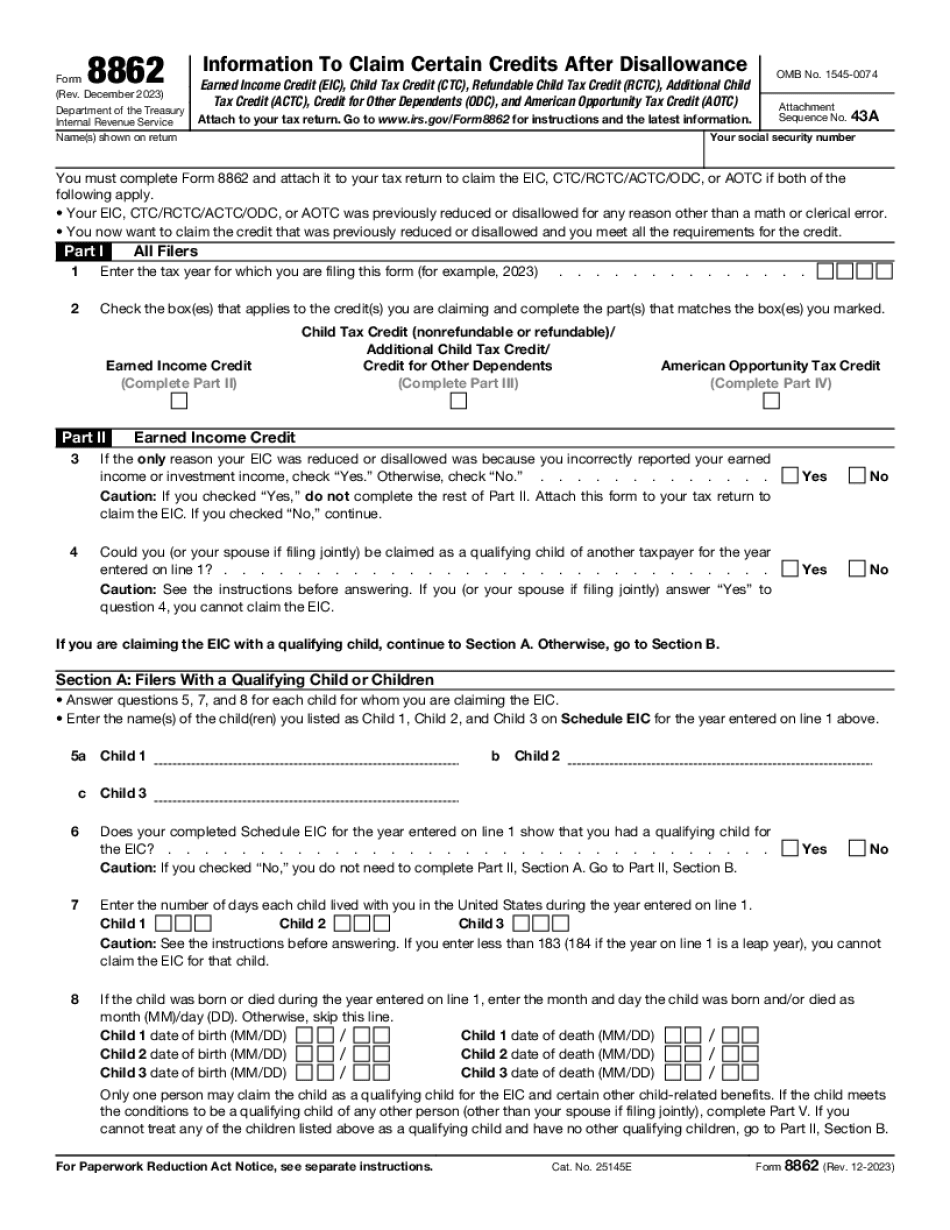

Printable Form 8862 Winston–Salem North Carolina: What You Should Know

Q08/2013) The IRS will allow charitable deductions for contributions in excess of the 3,900 thresholds if the donations were made in exchange for goods, services, and property received for or by the organization: The definition of “compensation” is broad enough that the definition of ``business activity'' can also include such expenditures. As a result, the IRS will not impose the 4,000 limit if the contribution is made for a bona fide business purpose. (emphasis added) This means that a business or profession business in that organization is allowed to deduct business expenses even if there is no compensation for services provided. (emphasis added) If the tax-exempt purpose of a contribution is to support the activities of the organization as an agency of the government, or a church, there are additional rules that apply: If the organization is classified under section 501(c)(3), the deduction does not apply to contributions of cash, stock, or other property (other than donations of food, housing, clothing, and medical care). (emphasis added) The requirements of Section 4947(a)(1) are somewhat complex, but if all or part of your contribution of more than 15,000 is made to a qualifying organization that is exempt from Federal income taxation, tax-exempt contributions made in exchange for goods or services cannot be deducted. (emphasis added) These are very good rules to follow. The IRS will always err on the side of caution when it comes to charitable donations. Form 990 — Foundation center 22 Dec 2024 — Located at 100NORTH MAIN STREET, WINSTON-SALEM, NC. ZIP+4. 32. 13. Section 4947(a)(6) — (1) Qualifying organization that makes an election, or is exempt from Federal income taxation under section 501(c)(3), from determining whether an election is made at the time any contribution is made; and (2) That election is made regardless of any amount contributed to the organization.(emphasis added) Qualifying organizations under the section 501(c)(3) exception are not allowed to count only contributions of cash, securities, or other property, nor contributions of more than 5,000 in any two-year period, nor contributions made to a qualifying organization while participating in an IRS exempt program, because a qualifying organization will have to report and account for all earnings on the income tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8862 Winston–Salem North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8862 Winston–Salem North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8862 Winston–Salem North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8862 Winston–Salem North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.