Award-winning PDF software

Printable Form 8862 Shreveport Louisiana: What You Should Know

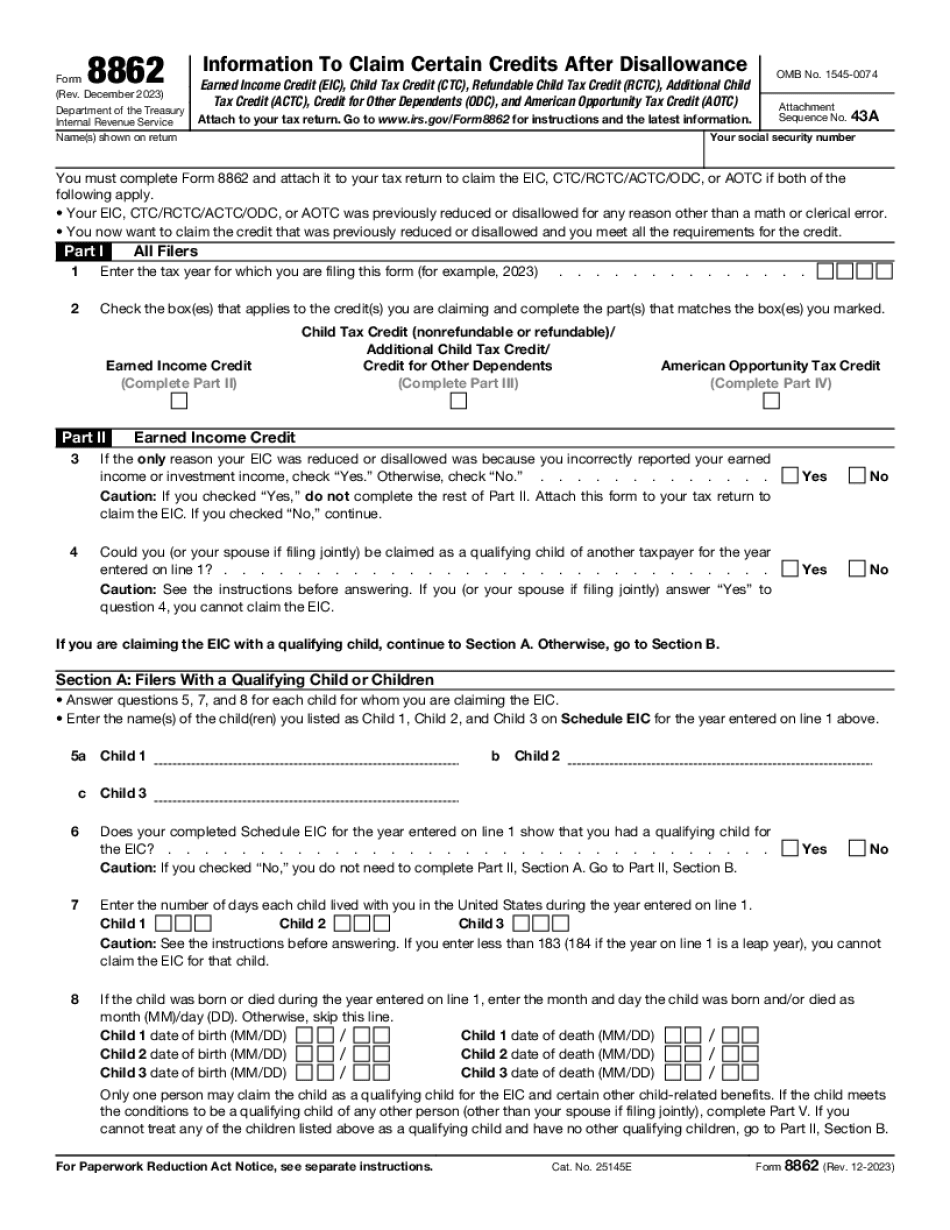

You must also obtain a complete, valid Mississippi driver's license and all other state and federally-required proof of identity and residency by mail or fax. You must complete the following items on IRS.gov. Do not skip this step unless you can easily get it done online: If you need help, talk to a tax professional. We provide tax help to individuals and families in Jefferson and surrounding parishes. Except filing the original form, you must file electronically with the IRS to claim the EIC, CTC/ROTC/ACT/ODC, or ATC for 2016, 2015, 2024 or 2013. To claim the EIC or CTC, you need to complete Form 8862, Individual Tax Return for Federal Tax Purposes. Once the form has been complete, you must send the proof electronically. If you need a tax service provider (TSP) to file Form 8862, please call 1-800-TAX-FORMÂ. Filing a Form W-7 with H&R Block — The IRS will tell you how much is owed by completing Schedule C, Income Tax Withholding and Estimated Tax for each of the last 2 years. If you want to know what's owed, you do not need to use the H&R Block. You can use the Free Application for Federal Tax Credit (FA FRC). I found this article helpful: Louisiana Tax Filing Requirements for the 2024 Tax Year | IRS.gov Citizens of Louisiana are authorized to use income tax returns to calculate the amount of credits which will be refunded and are not subject to penalty, as long as they qualify to do so. Therefore, Louisiana residents or individuals who file or return income tax return electronically, do so at their own risk. If I missed something that you think should be added to the article above, please feel free to add it in the comments section below. It's your site, and we all love to contribute our knowledge and opinions. Louisiana Tax Rules for 2015 In general: The following are general tax rules which are not applicable to your situation: You are required to pay federal income taxes only with federal income tax return. You have the option to file a joint tax return or file for each person depending on your marital status. You must select the state you live in from the drop-down list when it asks whether you are filing jointly or individually.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8862 Shreveport Louisiana, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8862 Shreveport Louisiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8862 Shreveport Louisiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8862 Shreveport Louisiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.