Award-winning PDF software

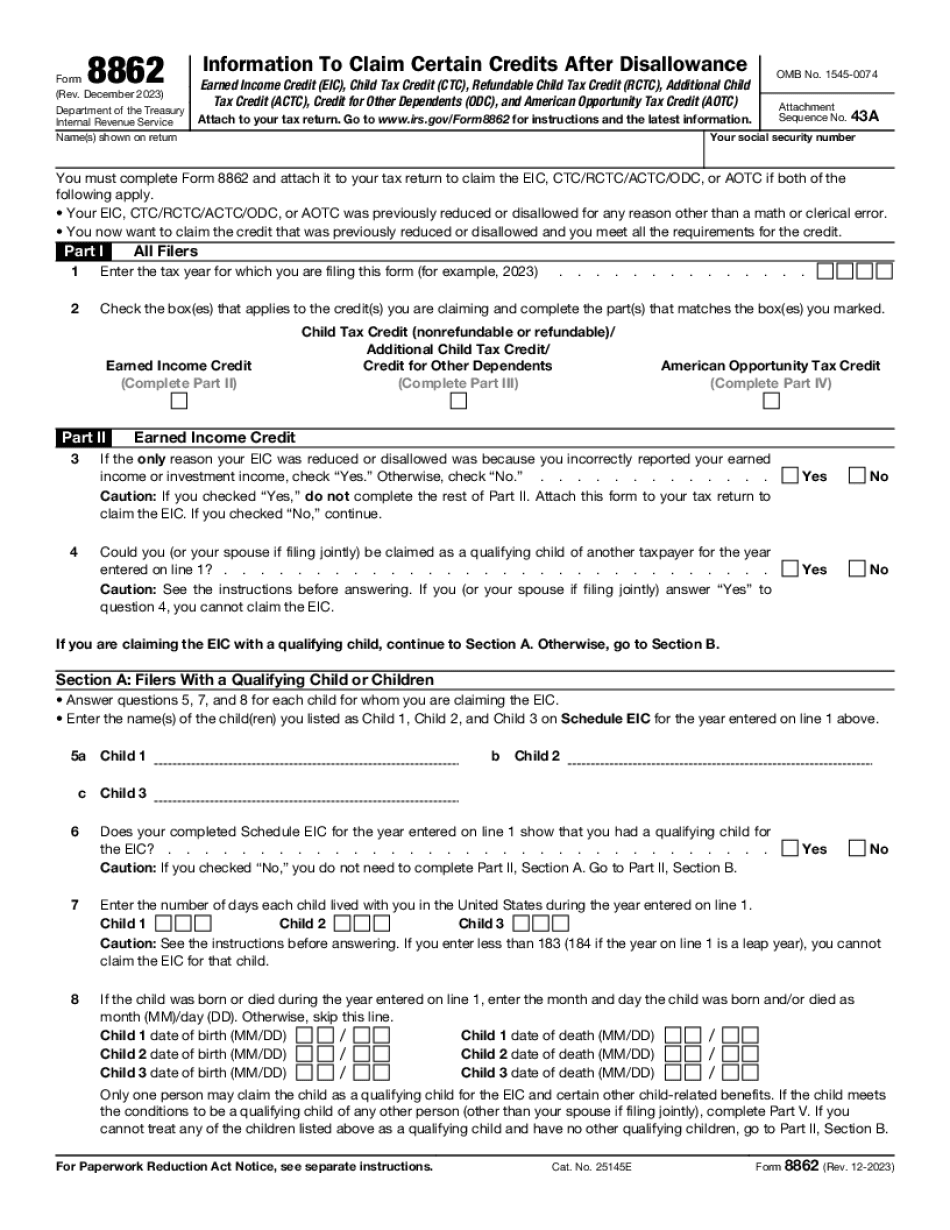

Nampa Idaho Form 8862: What You Should Know

Full basement. Two-car garages. Two cars detached garage. Master washer and dryer. The property is located 2.1 miles from Nampa city limits. The following is the property description provided to you at time of sale: SOLD AS IS. The property has been fully inspected. The home has been used by the seller on a short-term basis. The home has been on Craigslist.com for approximately 1 month. At this time the owner plans to use the home as a vacation home. Please call the seller at for a free Home Inspection. This property is offered by the seller under contract with a new owner, currently. The new owner has no plans to move in the immediate future. This property is under contract with a new landlord and current owner plan to remain on the property until the new owner is in a permanent place to live. Read my full response at: About the Nampa IRS Tax Code The IRS, like all other federal regulators, is obligated to maintain a reasonable and impartial enforcement of the laws in effect while acting in the federal capacity and within the jurisdiction of the IRS. That is why the IRS has adopted the following code of enforcement for purposes of conducting enforcement activities. The code of enforcement is not intended by the IRS to constitute a comprehensive statement of its policies and actions related to tax matters. The following policy statement is meant to help explain and interpret the legal framework as it applies to certain activities of the agency in tax matters. The Code of Enforcement is a guide used in the Internal Revenue Service (IRS) to help agents enforce federal tax laws that are generally applicable in the tax year. The Code of Enforcement covers three primary categories, each of which relates directly to IRS enforcement activities: Compliance With the Law Any activity which the IRS believes may reasonably result in, or will result in, the filing of a false return, including income tax audits and other IRS investigations. An individual's application for, or the failure to file, any federal tax return, including the preparation of any such return after an examination has been conducted.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Nampa Idaho Form 8862, keep away from glitches and furnish it inside a timely method:

How to complete a Nampa Idaho Form 8862?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Nampa Idaho Form 8862 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Nampa Idaho Form 8862 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.