Award-winning PDF software

Form 8862 Online Naperville Illinois: What You Should Know

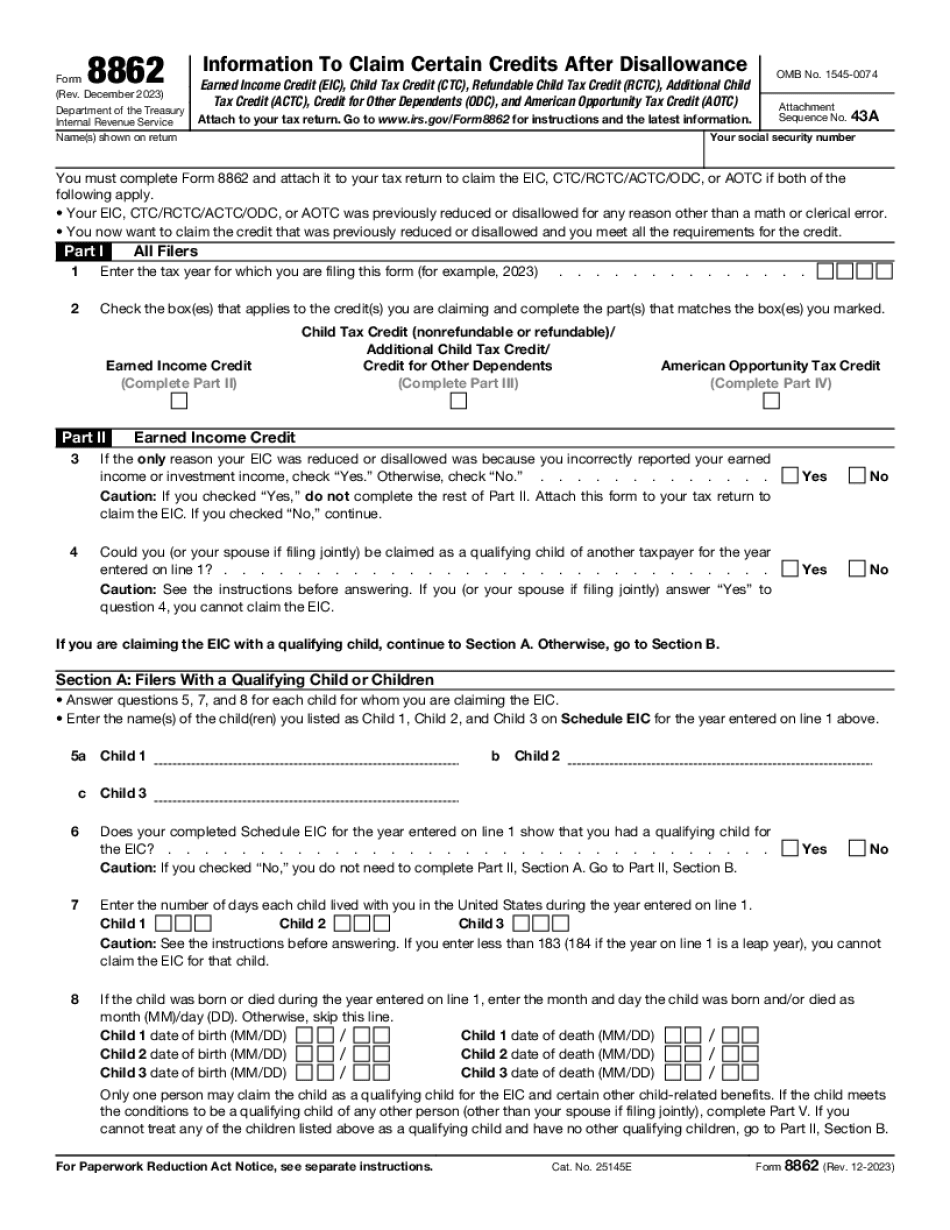

In many cases, it still may be a good idea to file tax form 8862 despite the fact that the EIC is not deductible. If the EIC are being claimed to be for a qualified business activity rather than a regular individual, it is reasonable to expect that there may be a tax advantage to claiming the EIC. There may, therefore, be times when it is reasonable to file tax form 8862 even if tax return Form 1040/1040A is sufficient to fully offset the loss. In fact, for many taxpayers, it may be more beneficial for you to complete tax form 8862 in order to take advantage of the EIC and claim the EIC after the loss is not fully offset. If you have a large family or many dependents, the EIC is an income tax credit that can be difficult to assess. The EIC is not subject to the standard deduction; therefore, the value of the EIC to the taxpayer is not easily calculable, even when the EIC is fully deductible. The EIC is also generally not carried over from year to year. The EIC cannot be received by the child or dependent of any individual upon his or her attainment of age 26; only by the individual or his or her parents. The EIC is based on the first 2,600, plus certain additional amounts (6,000 for dependent children and 20,000 for married couple who are filing joint returns). Therefore, if the EIC are fully deductible, the value of the EIC can be difficult to determine (and may not be a true tax deduction). However, if the EIC are not fully deductible, the value of the EIC may be determined more accurately and can be used to offset against other income such as wages, interest, dividend or capital gain. If you feel you should complete form 8862 but want additional details as to how the income tax credit is determined, and how it is calculated, then view the IRS Form 8862 overview. About Tax Form 8862 — IRS Tax Form 8862: Fill out and sign online — Chub In addition to completing the tax form, taxpayers must sign and notarize the back of tax form 8862. Do not send Form 8862 to the IRS until it has been signed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 Online Naperville Illinois, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 Online Naperville Illinois?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 Online Naperville Illinois aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 Online Naperville Illinois from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.