Award-winning PDF software

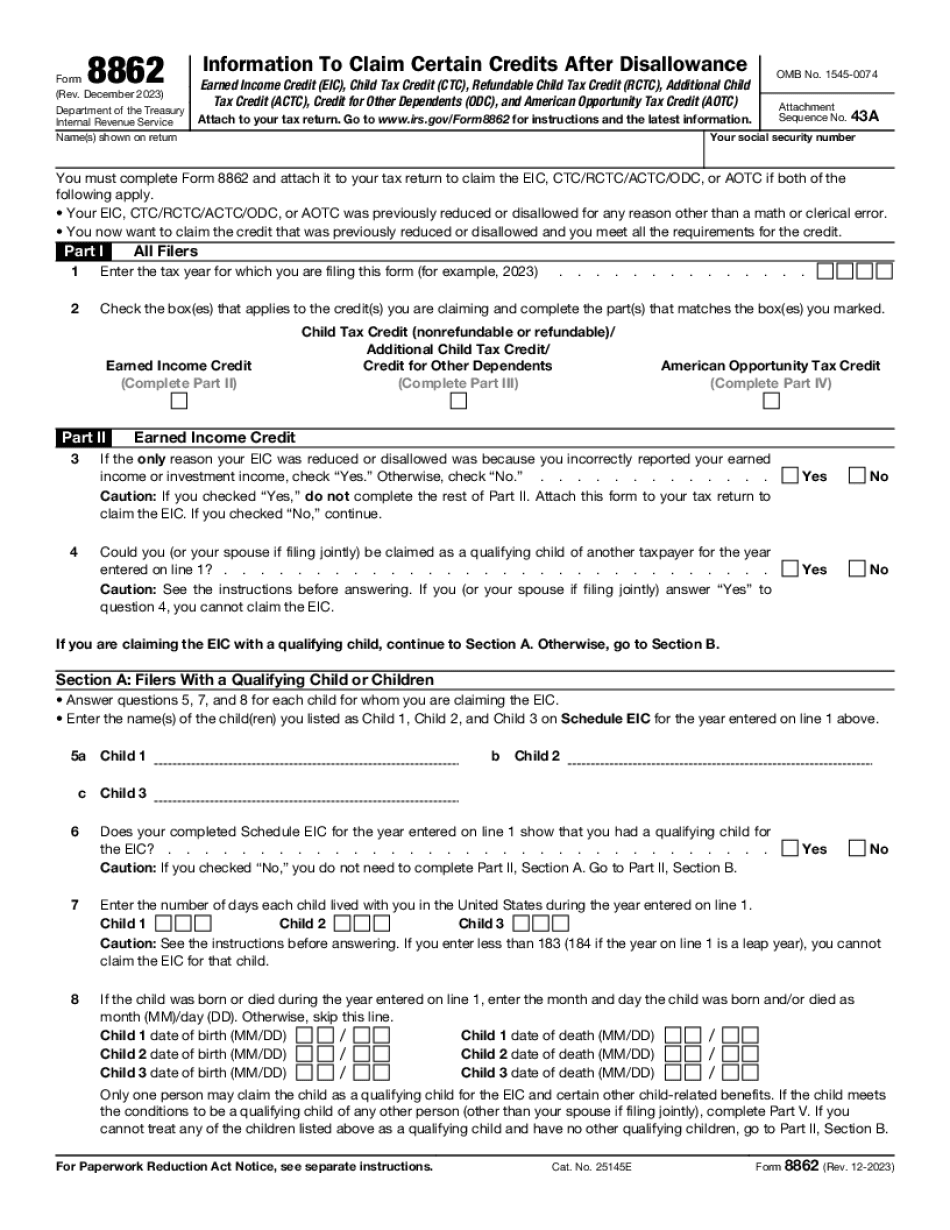

Form 8862 for Brownsville Texas: What You Should Know

By signing this form, I understand and agree that, except when specifically allowed or allowed by me as a reasonable business practice, no employee, independent contractor, representative, or agent under my control, at any time, shall: (a) work at a location that is a primary source of income, or (b) accept or receive compensation of any kind from or for the purpose of receiving, or from the business of selling, offering to sell, or promoting cigarettes or all smokeless tobacco products. By signing this form, I understand and agree that cigarettes and all smokeless tobacco products do not have any adverse health effects or other adverse effects on behavior not attributable to a change in nicotine or any other ingredient in cigarettes. Apr 12, 2024 — The Federal Tax Commissioner's Office shall, by rule, establish and ensure that employees of qualified employers (Qualified Business Income (FBI) participants) are informed about the Qualified Tobacco Use or Non-Tobacco Use tax credit, and in the case of the qualified employee, about the Qualifying Individual's filing requirements. Signing Statement under Penalty of Imprisonment for Tax Evasion or Fraud By signing this statement I accept and agree that the requirements I submit to the IRS under penalty of perjury on or before: May 04, 2018, at such time or times as indicated, I declare that I have filed your tax return, return information, or other information with the IRS using Forms(s) W-2G or W-2G-EZ, and pay the full amount of the tax due under this return or return information. (See below for details) If I do not sign this statement before May 04, 2018, a payment of the tax due under this return or return information will be deemed to have been filed or received prior to January 1, 2018, but with no liability. I agree to pay any tax owed on the balance of this refund check. If I decide not to sign this statement, or do not sign by May 04, 2018, a payment of interest will be added to the overdue and unpaid tax. This notice is in addition to any statement that I have previously made or provided to the IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8862 for Brownsville Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8862 for Brownsville Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8862 for Brownsville Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8862 for Brownsville Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.