Award-winning PDF software

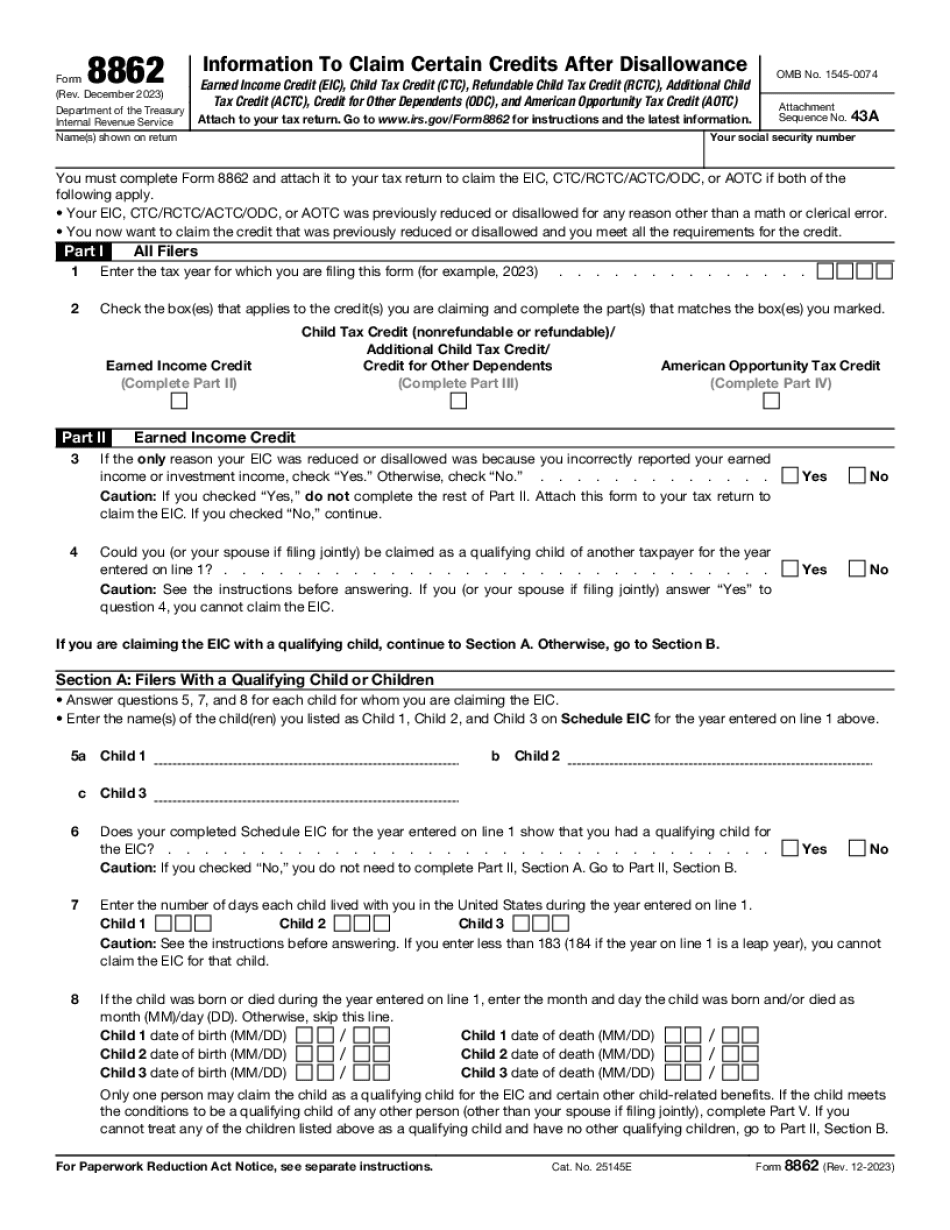

About form 8862, information to claim certain credits after

Disclaimers of Expected Losses Disclaiming Expected Losses is a complicated issue, one I see often in the C-Corner and sometimes in the W-Corner. The most important thing to consider, however, is that the actual loss may or may not come due to an unexpected break in customer service. In this post I'm going to cover the process of claiming the expected loss on your credit report, by explaining the expected loss rules for each credit bureau, the reasons a C-Corner or W-Corner would actually recover on their own, and how to know if you actually have a claim. The Credit Bureau Expected Loss Rules The actual rules that each credit bureau has on its ”reasonableness” of the anticipated loss on its credit report are: The C-Corner Expected Loss rules, for W-Corner and C-Corner, were last updated in 2005 (the year the rules were written) and were intended to prevent fraudulent activity related to credit reports.

form 8862 (rev. december ) - internal revenue service

Qualified reservist who served in a combat zone and was awarded EIC, CTC/ROTC/ACT/ODC, or ATC. Served in the combat zone (, an area in which military personnel are engaged to protect the United States) in which a military operation is taking place. Service in an area in which personnel from the Armed Forces of the United States are actively engaged to defend the United States. Qualified reservist who has a non-traditional military eligibility for retired, honorably discharged, or retainer. Qualified reservist who is eligible to be a CPL and who is stationed outside the United States and is receiving active duty pay because he or she is providing support to the Armed Forces of the United States by performing functions other than that of a soldier or serviceman. A qualifying reservist also must meet the other standards for qualifying as a CPL. In addition, in the case of a service.

Filing tax form 8862: information to claim earned income credit

These households have been struggling for some time, and the credit's value represents a true tax break. It can add 2,000 or more a year to families' wages, and with EIC, families can pay themselves more money each month. In some cases, the EIC and other tax credits can significantly lower the taxes the middle class and poor have to pay each year. In the past, the Senate proposed reforming the EIC, but never passed. President Obama could pass a bill and pass it, but only if Congress acts quickly to address the economic crisis. (H) The Federal Reserve has significantly increased interest rates, even above those required by law. With the Fed's actions, the federal government has received an additional trillion in interest payments. However, there are many other ways for taxpayers to pay down federal debt over time, without additional interest payments on the debt. In fact, the.

What is form 8862?

In other words, while the IRS may have originally disallowed the tax credit in question to reduce the amount of credit you will benefit from, the deduction will be awarded to you if your new returns for the year of the disallowed credit show no tax owed. So if someone is having some trouble understanding 940Q8 in what you are suggesting, have a look here for clarification.

Form 8862 - information to claim certain credits after disallowance

The taxpayer's adjusted gross income for a preceding taxable year is greater than or equal to 100,000 but less than 110,000. 2. The taxpayer's adjusted gross income for a preceding taxable year is less than 100,000 but equal to or greater than 110,000. 3. The taxpayer's income for a preceding taxable year is 100,000 or more. 4. The taxpayer has reported at least 80 percent of his or her income from self-employment on a tax return for the taxable year. 5. The taxpayer has reported at least 80 percent of his or her income from self-employment, but the taxpayer qualifies for the lower of the following two exclusions: a. The taxpayer reports an adjusted gross income of less than 80,000, or b. The taxpayer is a qualifying individual. You can submit Form 8862 to the IRS in person or by mail. The completed Form 8862 is mailed to you by the IRS within 90 calendar days..