Morning all, Nizar Scott here with NS tax service. This weekend, we're going to be discussing tax credits. I want to start today off by talking about the Earned Income Credit. For those of you who may be claiming this, there are three things you need to take into consideration. First thing is going to be your total income. Second thing is going to be your filing status. Third item is going to be the number of dependents that you claim on your tax return. Okay, there is a situation for individuals who don't have dependents to claim to still take advantage of the Earned Income Credit. Two things you need to know: First thing is you need to be between the age of 25 and 65. Second thing is your income can be no more than fifteen thousand ten dollars. Now, this credit is a refundable credit and anyone taking it on their tax returns, you will not see your refund until after February 15th. Earned Income Credit should be completed on schedule EIC. Please remember to like, comment, subscribe. Take care and happy filing season.

Award-winning PDF software

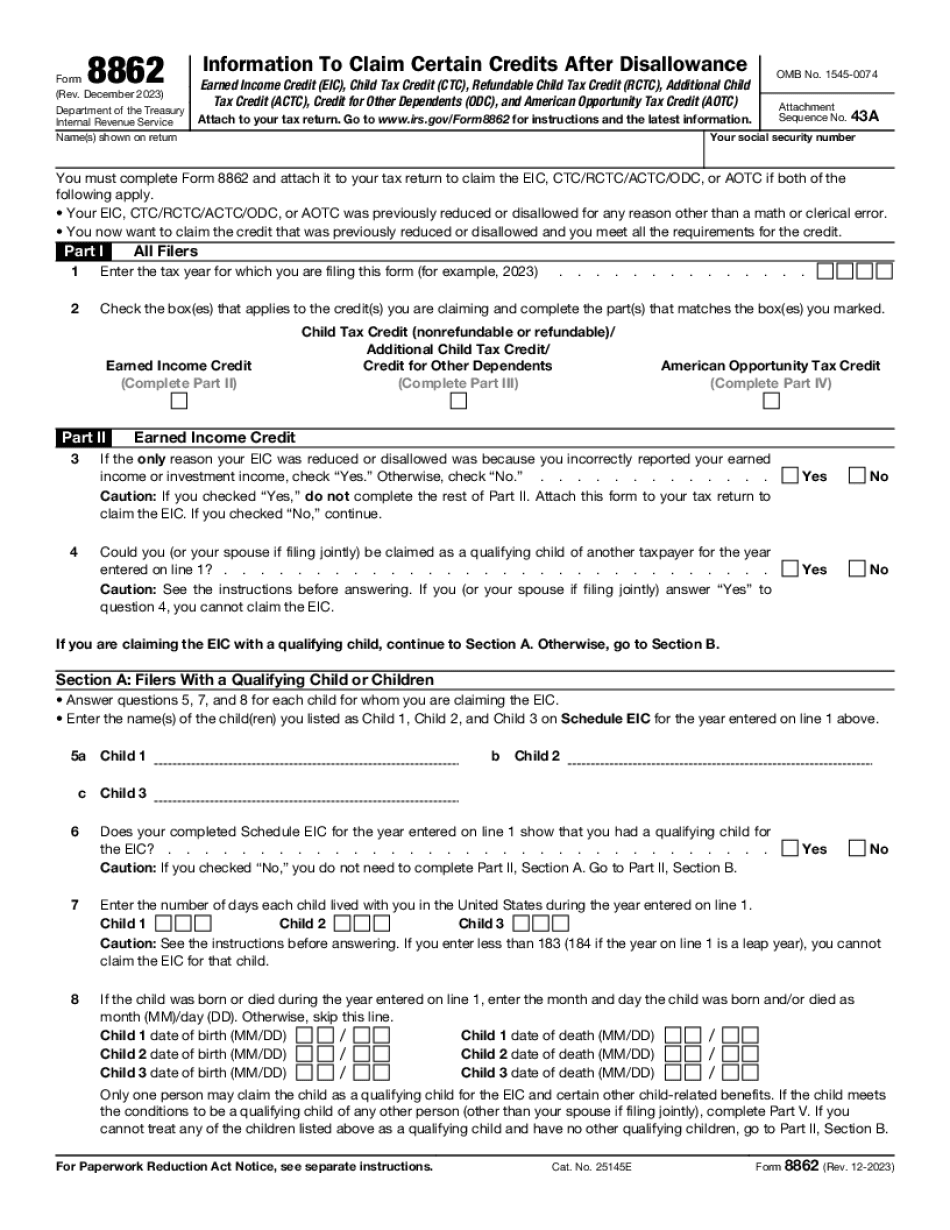

Will 8862 delay my refund 2023-2024 Form: What You Should Know

IRS Issues Erroneous Credit — IRS Tax Return Errors on Returns with ETC/EW TI/ETC/EW ITC — U.S. Taxpayer Advocate Aug 30, 2024 — With respect to the ETC, if your tax return erroneously claimed the credit only to have the IRS reverse that decision, the IRS has told you to get filed another Form 8442A and a Form 8643 to claim the credit again. You should do this because you might never receive a refund under your original tax return after filing for the ETC. Tax Returns with Earned Income Credit/ETC — Filer's Rights Sep 18, 2024 — If your IRS returns have any errors on income tax, you should file an amended tax return with a corrected ETC/EW TI and a Form 8862 or Form 8821, U.S. Individual Income Tax Return (Form 843 may be filed), to claim the credit. You will need to file Form 8442A and a Form 8643 to earn the credit again. What You Can Do — How the IRS Can Help You may have made errors on your tax return. If you get a refund, it's important to know why the IRS is giving it to you. To find how the IRS can help you file amended returns, find out if you are eligible for Tax Counseling and Representation. Learn more about what to do and what NOT to do if you're having trouble with your return now, and how to work with tax professionals to keep things straight. Get the most from Tax Services — A Financial Perspective Taxes and refunds can add up over time unless you pay attention to where and how you spend your money and where you can save. The financials of your business, and the way you manage your finances is critical to your success. The more efficient way to do this is to work with a professional and take care of your business finances. There are great tax planning services that can help you learn about you and your situation, while giving you advice on what changes to make your tax return and finances run smooth.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8862, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8862 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8862 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8862 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Will Form 8862 delay my refund 2023-2024