Congratulations on your win! Now, step-by-step, we're gonna show you how to fill out your claim form. Remember, if you don't fill out this form correctly, your prize payment check will be delayed. So, let's begin. First, download a claim form from the California Lottery website at CA lottery.com. Click on "Win" and then scroll down to "Winner's Claim Forms." You can see that the forms are available in five different languages. If you can, complete the English form online because typed documents are easier to read. Illegible forms are a common mistake that delays prize payments. Let's start with the player information section. You must enter your full legal name. This is important. Your last name goes first, and your first name goes below to the right. Enter your middle initial here. People putting their first name in the last name is a common mistake. Your legal name that you enter on your claim form must match the name printed on the winning ticket. Next, you need to enter your full address as recognized by the US Postal Service. This includes any apartment or suite number. Don't forget the city, state, and zip code. Enter your phone number, including area code, here, and your email address right here at the top right of the form. Enter your birth date. Month goes first, followed by day, and then year, like this. Leaving these fields blank is a common mistake. Right below, enter your social security number or taxpayer identification number. This information is required for winners who are not US citizens or who are not resident aliens. No problem, you can still claim your prize. Leave the SSN/TIN blank and instead, check both "Yes" for "I do not have a social security number" as well as "I am NOT a US citizen" and "I am...

Award-winning PDF software

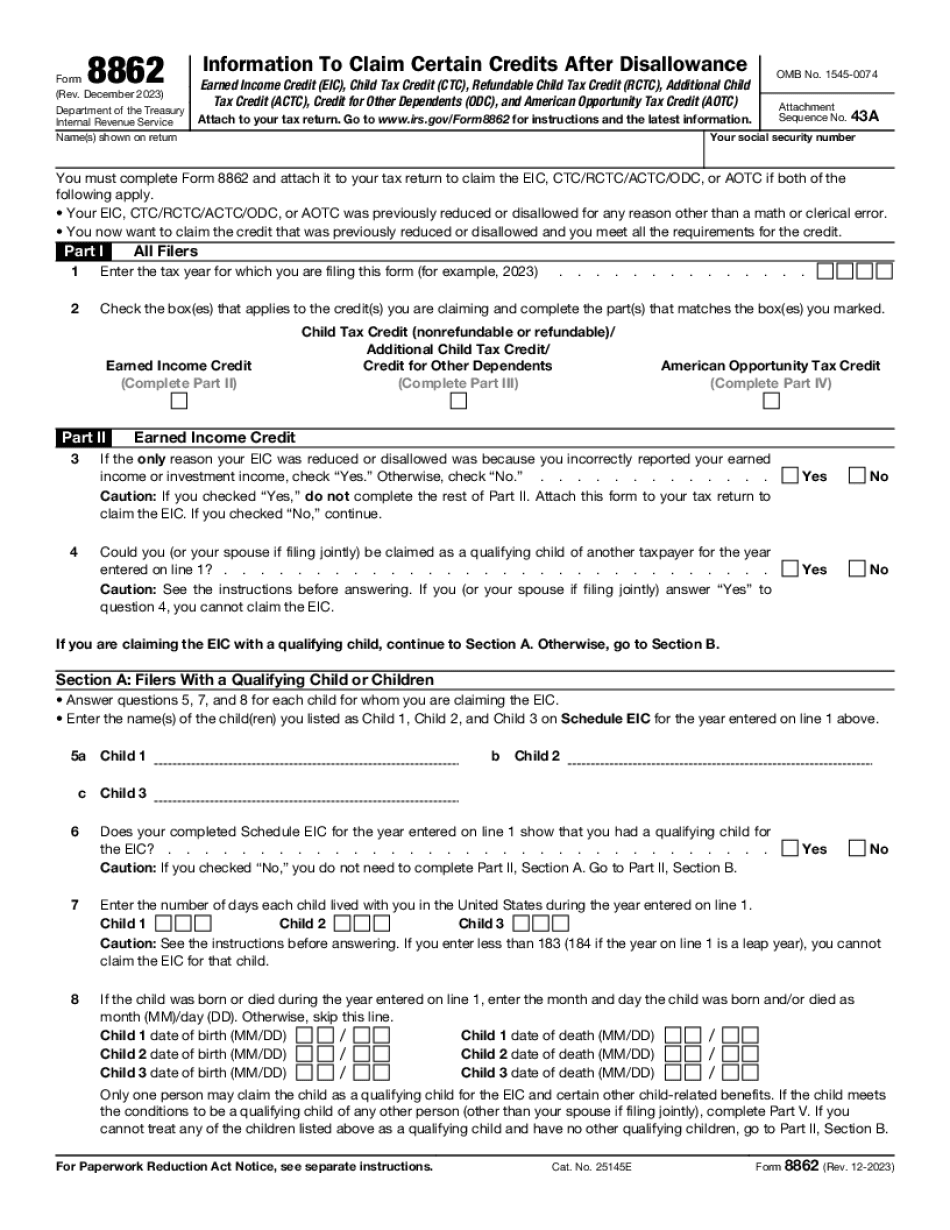

How long does it take to process 8862 Form: What You Should Know

A new Turbo Tax Year that's fast and simple for everyone — your first! About Form 8862, Information To Claim Certain Credits — IRS Taxpayers complete Form 8862 and attach it to their tax return if: Their EIC or CTC/ROTC/ACT/ODC is due from a claim filed after 6/30/17 Tax Prep Dispatch: Bring on Form 8862! — Prosperity Now Apr 12, 2024 — Once a “Yes” answer has been entered for any of these credits, Form 8862 is in the tree and completion is required. What is Form 8862? — Turbo Tax Support Video — YouTube What is Form 8862, and when might it be required? Watch this Turbo Tax guide to learn more. YouTube · Turbo Tax · Jan 7, 2024 — TurboT ax Ready! Another Turbo Tax Year that's fast and simple for everyone — your first! For Taxpayers With Credit/Refund Determined After June 30, 2024 | Tax Form Information. June 30, 2024 — The credit or refund is due from a claim that was filed after 6/30/18. See IRM 10.1.5.4.1.6. A Form 8862 is used by the Internal Revenue Service (IRS) to determine credit/refund eligibility with respect to Form 941, 1040, 1040A, or 1040EZ, Form 1040A4,1040F, 1040G,1040H, or 1040NR. The IRS has no authority to change the terms of a refund/credit determination in a prior year (or after a claim has not yet been filed) unless specified in Treasury Regulations. IRM 10.1.5.4.1.7.10.3.2(i) Credit or Refund Eligibility Information About Credit/Refund Eligibility 10.1.5.4.1.6.18(a) Credit/Refund Eligibility Based On Other Exemptions A. The taxpayer paid the credit or refund due to a qualified adoption credit claim not claimed or not claimed for prior tax year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8862, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8862 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8862 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8862 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How long does it take to process Form 8862