Every one today, I wanted to go over the qualifications for the Earned Income Credit. When you have one or more children, whether married or single, there are a total of five steps we will need to go over. Although my primary focus is for those with W-2s only, I will briefly go over step two. Each step will have a few questions, and based on your answer, you'll be able to figure out if you can take this credit or not. Let's get started. Step one is to figure out if you even qualify. There are three different scenarios depending on how many children you have and your filing status. Depending on your personal situation, you need to find which scenario fits. When you figure out which scenario fits your life, you want to then look at the income requirements. If you made more than the numbers pictured according to how many children and your filing status, you cannot claim this credit. Next, you want to make sure that you have a valid Social Security number. If your Social Security card states "not valid for employment," you cannot take this credit. If it states "valid for work only with DHS authorization" or if it's blank, then you can continue. If your filing status is married filing separately, you cannot take this credit no matter how many children you have. If you have foreign earned income, you cannot take this credit. If you are a non-resident alien and filing single, you cannot take this credit. If you are married filing jointly, continue to the next step. Step two is investment income. As I stated earlier, my focus is more on those with W-2s only, so this section will be brief. First, you want to add all of your investment income from any...

Award-winning PDF software

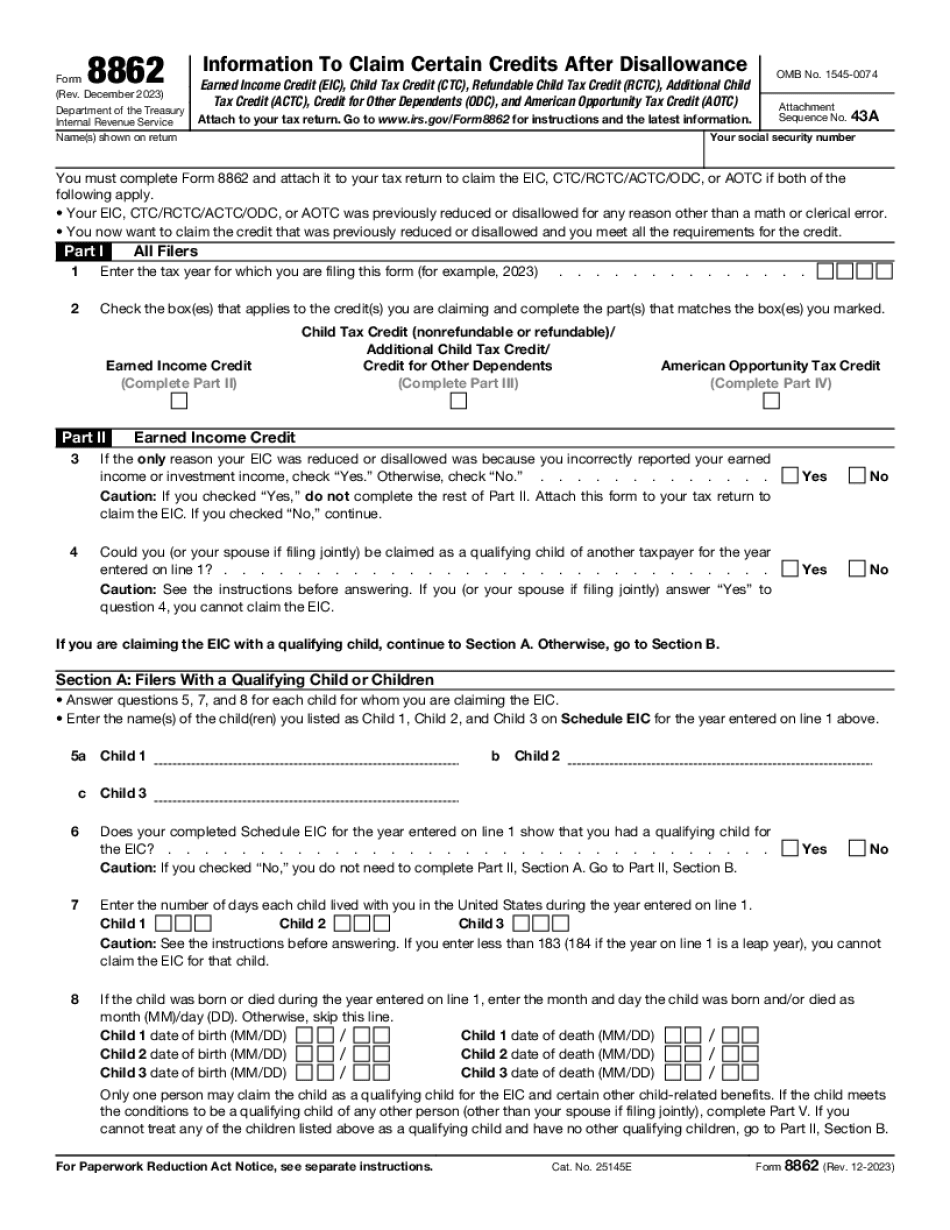

8862 2023-2024 Form: What You Should Know

IRS 8862 ≡. Fill out Printable PDF Forms Online — This paper is created when you submit your Form 8862 to the CRA (see below). The paper indicates all the information the CRA needed about your last tax return. IRS 8862 Form 1040 Form 1040 — This is the complete form you will use if you filed your tax return using the 1040NR or 1040NR-EZ. As of January 2018, tax return due dates are March 15 and April 17. The CRA asks you to file this paper if you have a change of circumstances that changed your circumstances from 2024 to 2018. It states the tax credit you will be entitled to if you filed your tax return under the previous tax year. IRS 8862 form — fill out form IRS 8862 form — fill out form Information To Claim Earned Income Credit. You are required to fill out this paper after IRS 8862 form. Your EIC, CTC/ROTC/ACT/ODC, or ATC. IRS 8862 Form 101/1040 Form 101/1040 IRS 8862 form (EIC) (if filing a joint return) Form 8862. Information To Claim Earned Income Credit Based on Change in Circumstances Information To Claim Earned Income Credit Based on Change in Circumstances. Tax Credits 2024 Tax Credit Form 8862 You Are Required to File Form 8862 When Your Tax Return has Been Discontinued. You are required to attach this form to your tax return if your application for a tax credit had been previously disapproved or declined for any reason. IRS Form 11th Amended Form 2106 Form 1079 The First-Time Homebuyer Credit IRS form 8862 form — fill out form 8862, 2024 Form 8862: What To Claim as an Earned Income Credit. If your tax return has been denied due to erroneous or fraudulent information, the IRS will ask you to download a paper form on which you will claim this credit. The paper identifies the error and describes how the erroneous or fraudulent information may result in a loss or a credit or tax credit. (see Form 8862 (Rev. December 2021) for more details) IRS Form 8862 ≡ Form 8862. 8862Form (Rev.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8862, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8862 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8862 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8862 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8862 2023-2024