Hello everyone, this is Matthew from my love free software TV. In this video, I'm going to show you how to file taxes online for free using the TurboTax Free File program. First of all, go to the TurboTax website. You will find the link for it in the description below. Once on the website, click on the "See if you qualify" button to find out if you can file your taxes for free. You will be asked some questions. If your answer is yes to any one of them, then you qualify for the free filing option. Now click on the "Start TurboTax Free File Program" button. You will be asked to create an account and login. After you do that, you will be taken to your dashboard where the website will start asking you questions. The first section is about your personal information like name, date of birth, occupation, social security number, marital status, etc. Once you are done filling in this information, then you move on to the income section. In here, you get two options. In the first one, the website will walk you through all the income categories step by step, whereas in the second one, you will be shown categories and you can choose which ones you want to work on. Let's start the income section by entering W-2 information. When you are done entering the info, you will be shown a refund amount on your screen. Click the continue button, and you will be shown a screen to see if some uncommon situations apply to your W-2. Choose accordingly and click continue. You can add another W-2 if you have one. Now you can move on to other income options like unemployment received, retirement income, interest income, rental income, business income, etc. Then we move on...

Award-winning PDF software

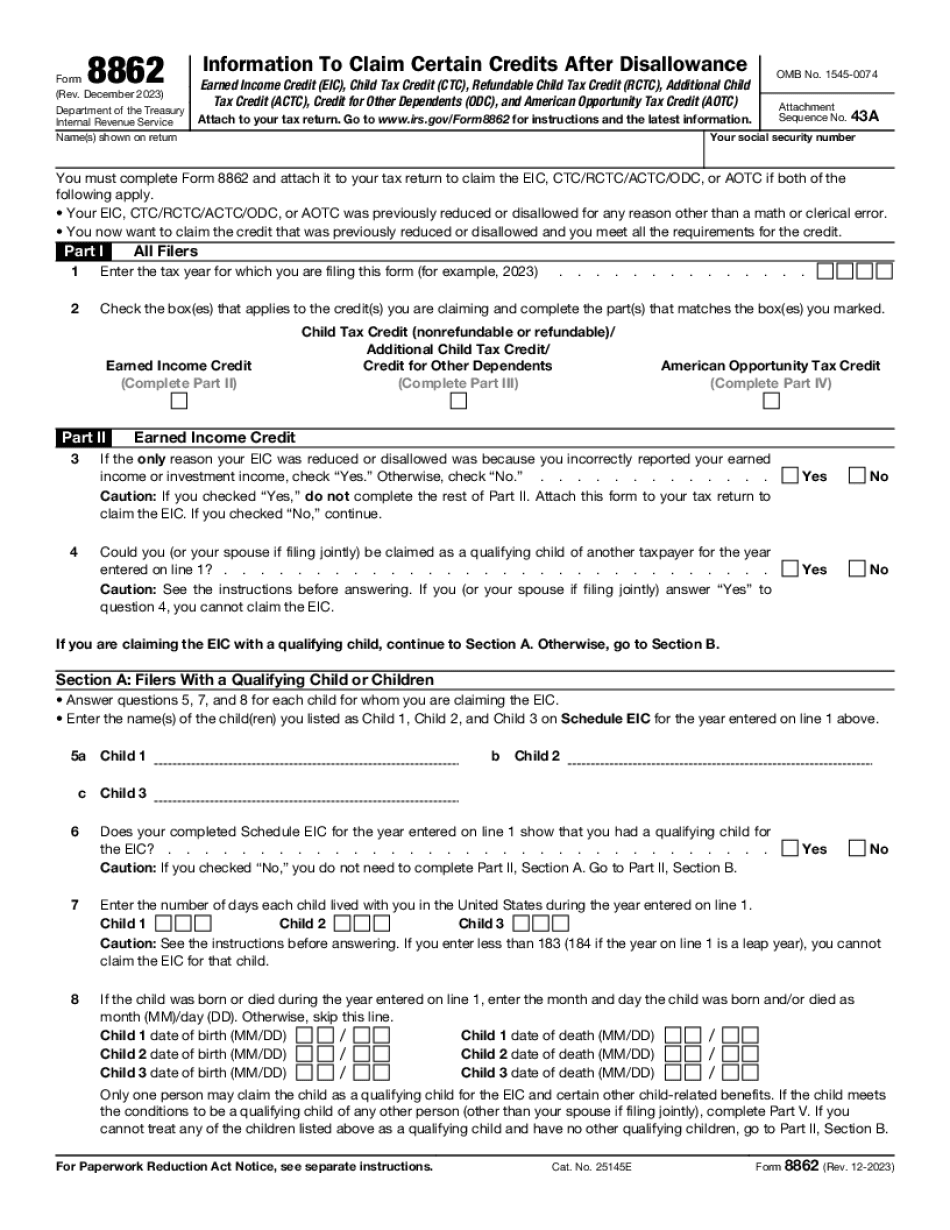

How to fill out 8862 on turbotax Form: What You Should Know

They are eligible for the credit(s). They can prove their eligibility in a supporting document. What's the EIC, CTC/ROTC/ACT/ODC, or ATC? The EIC is an income tax credit offered to taxpayers because your earned income tax credit (EIC) is reduced if your adjusted gross income is less than or equal to the poverty line, the total of all federal benefits, and any income tax reductions (deductions) that you receive. Generally, you don't need to meet any of these situations to claim the EIC. The CTC/ROTC/ACT/ODC is a tax deduction if you receive the CTC or ROTC or ACT from either the U.S. military or U.S. state/local governments that provides you with an education or training. Learn more in IRS Publication 523. You get the ATC for qualified tuition and related expenses, and the DID, if you are a veteran of the U.S. armed services. You must be able to prove you had to repay all your student loans as a result of your service. Get forms 523 and 544 from your education institution if you qualify for a disability exemption from paying your student loans and need an exemption form. How do I file Form 8862 if I need to do it for the first time? If you need to file Form 8862 in 2017, you'll likely enter all the information you need to claim the EIC on Line 7 of your tax return. You'll have an Earned Income Credit (EIC) on Line 16 of the return. If you didn't file any Form 8862 in 2017, enter your credit and expenses on line 7 of Form 8862. You will also need a certification of eligibility for the program. Make sure your certification is dated and signed. To find out if you qualify as an unemployed/disabled individual, see the page about claims with no qualifying documentation, also referred to as Pamphlet F. Once you see the amount at the bottom of line 7 of the form (EIC), enter your filing status on line 8 and type in the amount. It will look something like this if Line 7 of Form 8862 is left blank.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8862, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8862 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8862 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8862 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How To Fill Out Form 8862 On Turbotax