Below is the corrected version: "Now, there's a phone call. 8862 Indian 62 is technically for the tax preparer. It is when you bring your 1095 a, this information in. They're going to be reported on in 88 62 for the iOS. The reason we do that video is because most of the time when the taxes delay, the IRS is asking you for that 8862. You don't have a clue what is bad, okay? It is not a form that you produce. We have nothing to do with the 1095 a that you bring to the tax preparer. That's going to be used to fill out that 8862 that the IRS requires you.

Award-winning PDF software

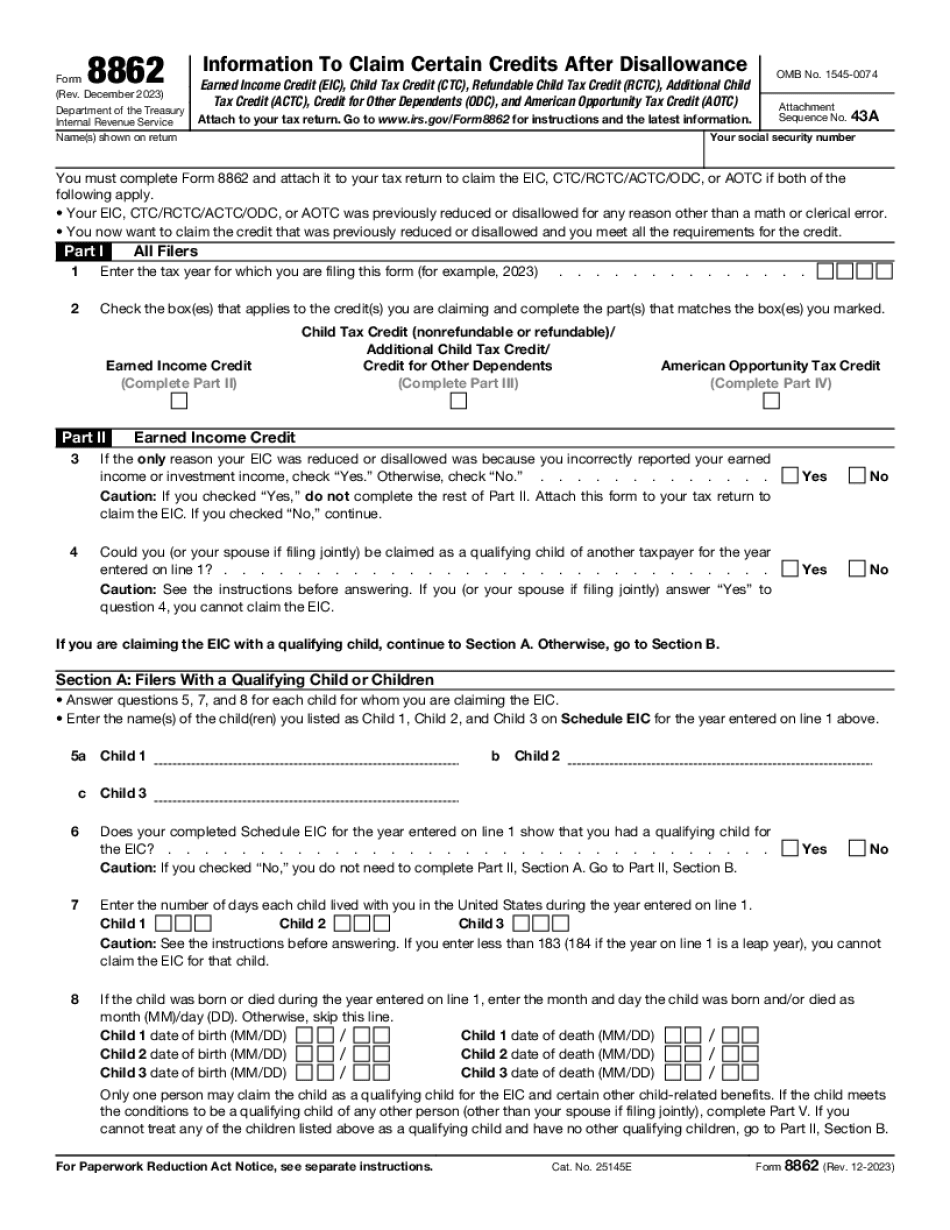

8862 Form: What You Should Know

Form 8949, Claiming the Child Tax Credit — IRS Apr 17, 2024 — If your qualifying child has not filed a tax return, and you are a qualifying parent of the child, you may be able to claim a tax credit up to 2,000. If my qualifying child has not filed a tax return and I am a qualifying parent, could I claim a child tax credit for the additional children? Yes if one or both of the following apply: Your child is: A dependent for your tax purposes If my child is not a dependent and my income is more than the 1,000 annual income limits for the family, could I claim a cash child tax credit? No for a cash dependent If my child pays for all of his/her own medical care and his/her income is close to the income limits for the family, could I claim a cash dependent child tax credit? No for a cash dependent Child and Dependent Care Tax Credit What is The Child Tax Credit? The Child Tax Credit is a refundable tax credit that is intended to help lower-income working families pay for basic child care expenses. The maximum amount of the credit for 2024 is 3,000 per qualifying child. What is the Child Tax Credit? The Child Tax Credit is a refundable tax credit that is intended to help lower-income working families pay for basic child care expenses. The maximum amount of the credit for 2024 is 3,000 per qualifying child. For 2017, if you are the owner of a child who does not live with you, you may claim a credit up to the amount of child support you pay. If you are the mother or father of a child who lives with you, you may claim the same amount of 3,000 for the child. Your modified adjusted gross income must be below 60,000 and not married filing separately to claim the credit. You must be married filing jointly if you pay the full amount of child support ordered by a court. If you live with other people, you cannot claim the credit. What is the Child Care Tax Credit? You may claim 6,000 of the 4,800 credit if you are filing a joint return. It must be included in qualifying child's income and not used to reduce your own qualifying child's income for the year. Qualifying child must be age 5 or younger at the end of the year in order for the child care credit to be given to your child.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8862, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8862 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8862 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8862 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8862